Do you think taxes when you retire will be higher or lower than they are today? If you suspect they are likely to be higher, a Roth IRA may be a good option for your retirement savings. The money you contribute to a Roth IRA today has already been taxed, so when you retire and start withdrawing, the money – and any potential growth in the account – may be tax free. And Roth IRAs offer a lot of flexibility even before you retire.

How much you can contribute

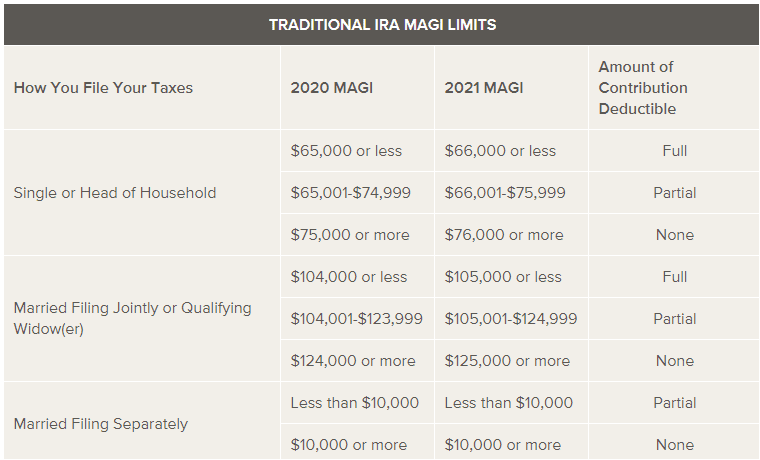

You can contribute to a Roth IRA as long as you (or your spouse) have taxable compensation. How much you can contribute depends on your modified adjusted gross income (MAGI).

A "full contribution" for 2020 and 2021 is $6,000. And if you're 50 or older, you can contribute an additional $1,000. This is called a "catch-up" contribution.

If you qualify for a partial contribution, your financial advisor can help you determine how much you can contribute.

If you are not eligible to make a contribution at all, a Roth IRA isn't out of the question. You may still be able to take advantage of tax-free income in retirement with a Roth conversion. Please consult with your tax advisor.

When you can take money out

You're generally not taxed or penalized when you withdraw your Roth IRA contributions and earnings. However, if your Roth IRA account is not at least 5 years old or if you're not yet 59 ½, the earnings portion of the withdrawal may be subject to taxes and a 10% penalty, unless an exception applies.

And unlike with Traditional IRAs, the IRS does not require the original account holder of a Roth to take any required minimum distributions (RMDs) when they reach age 72. You control when you want to withdraw your money. If you don't need the money in your Roth, you can leave it alone and it may continue to be tax free – and so will any potential growth.